TAX ENVY PRO SOFTWARE

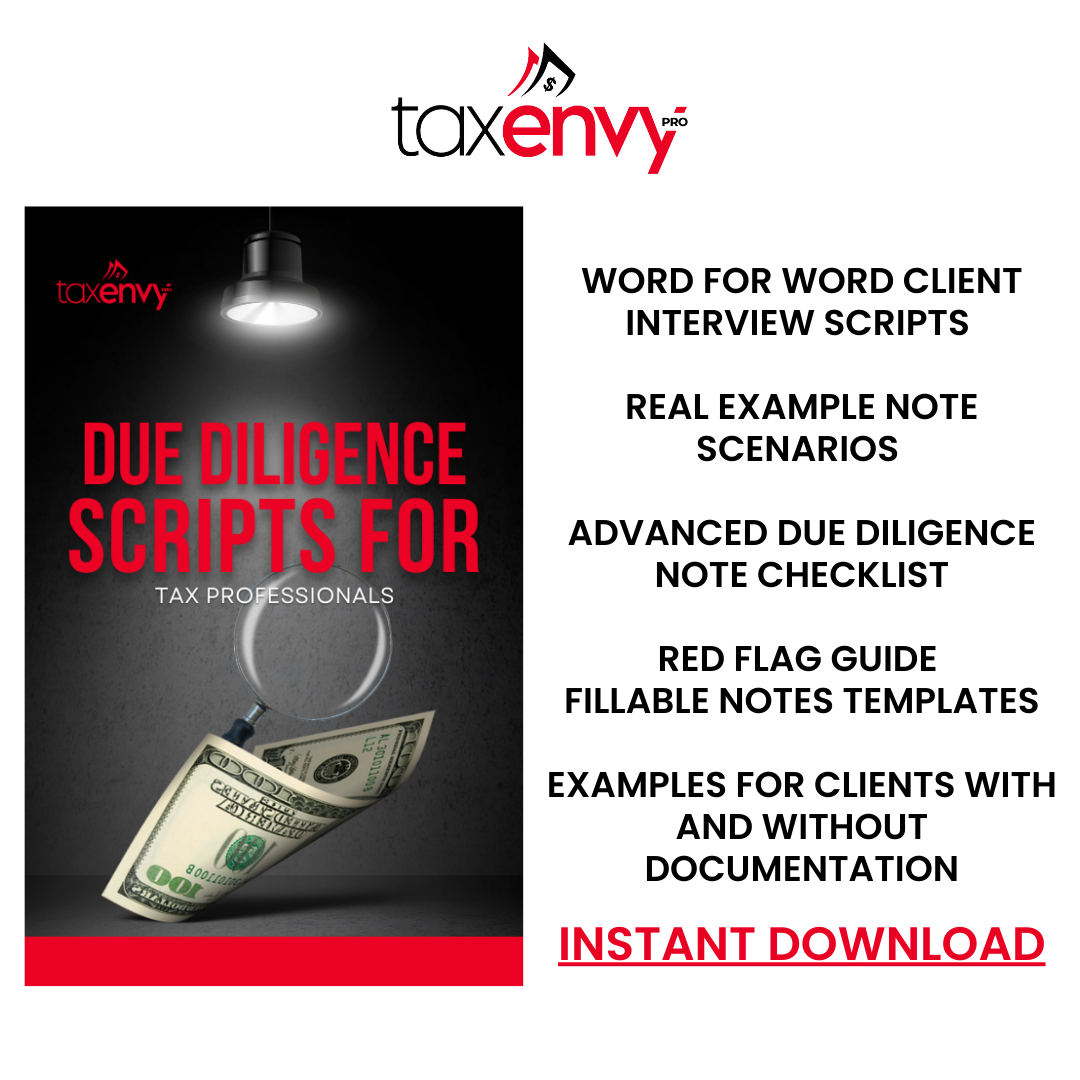

Due Diligence Scripts for Tax Professionals

Due Diligence Scripts for Tax Professionals

Couldn't load pickup availability

Stay audit-ready and protect your practice with the Due Diligence Scripts for Tax Professionals eBook — your step-by-step guide to handling IRS red flags the right way.

This advanced resource gives you:

-

✅ Word-for-word scripts to ask clients the right due diligence questions.

-

✅ IRS references (IRC §§, Form 8867, Pub. 4687, and more) for full compliance.

-

✅ Real example notes showing how to document questions, answers, and outcomes — exactly how the IRS wants to see them.

-

✅ With & without documentation cases so you know what to do when clients don’t have paperwork.

-

✅ Quick-reference tools:

-

Advanced Due Diligence Checklist

-

Red Flag Guide

-

Fillable Notes Template

-

Whether you’re filing EITC, CTC/ACTC, HOH, AOTC, or returns with self-employment income, this guide walks you through what to ask, what to write, and how to stay compliant while building client trust.

Why You Need This eBook:

IRS penalties for failing to comply with due diligence are $600 per credit, per return. This eBook ensures you have a clear, professional system in place to protect yourself and your business.

📘 Format: Digital PDF (instant download)

📅 Retention-Ready: Includes templates you can use to keep compliant files for 3 years

⚡ Perfect For: Independent tax preparers, tax offices, and service bureaus training new staff

Share